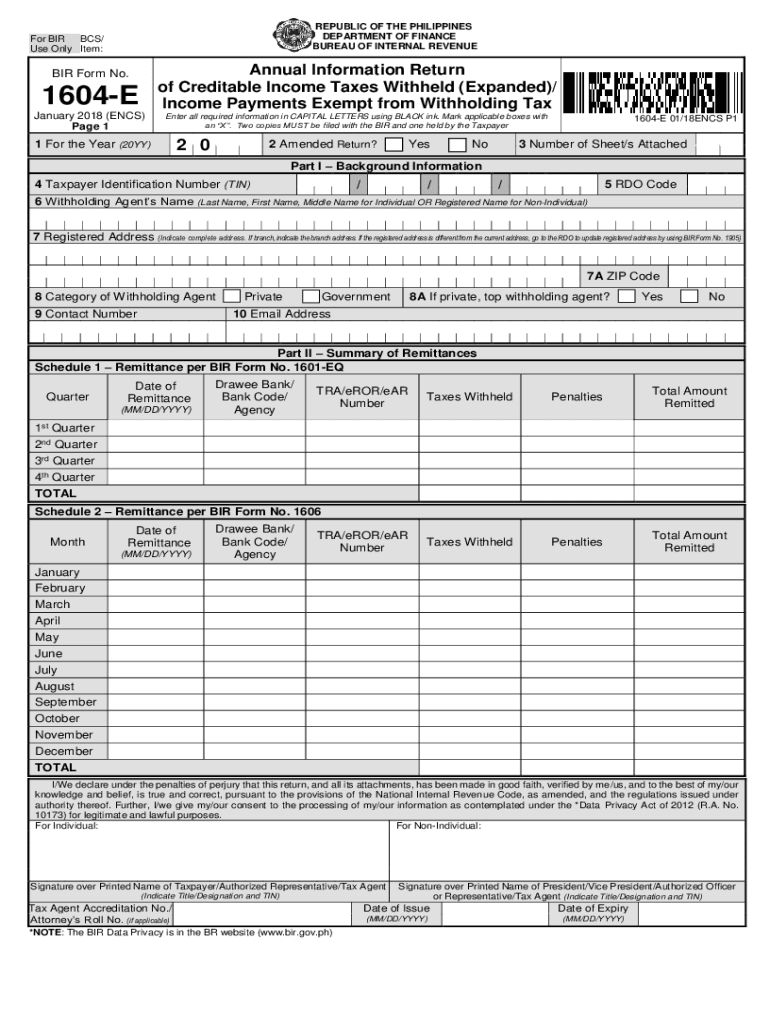

The BIR issued the revised BIR Form No. 1701Q (Quarterly Income Tax Return) January 2018 (ENCS) in conformity with the provisions of the Tax Reform for Acceleration and Inclusion (TRAIN) Law.

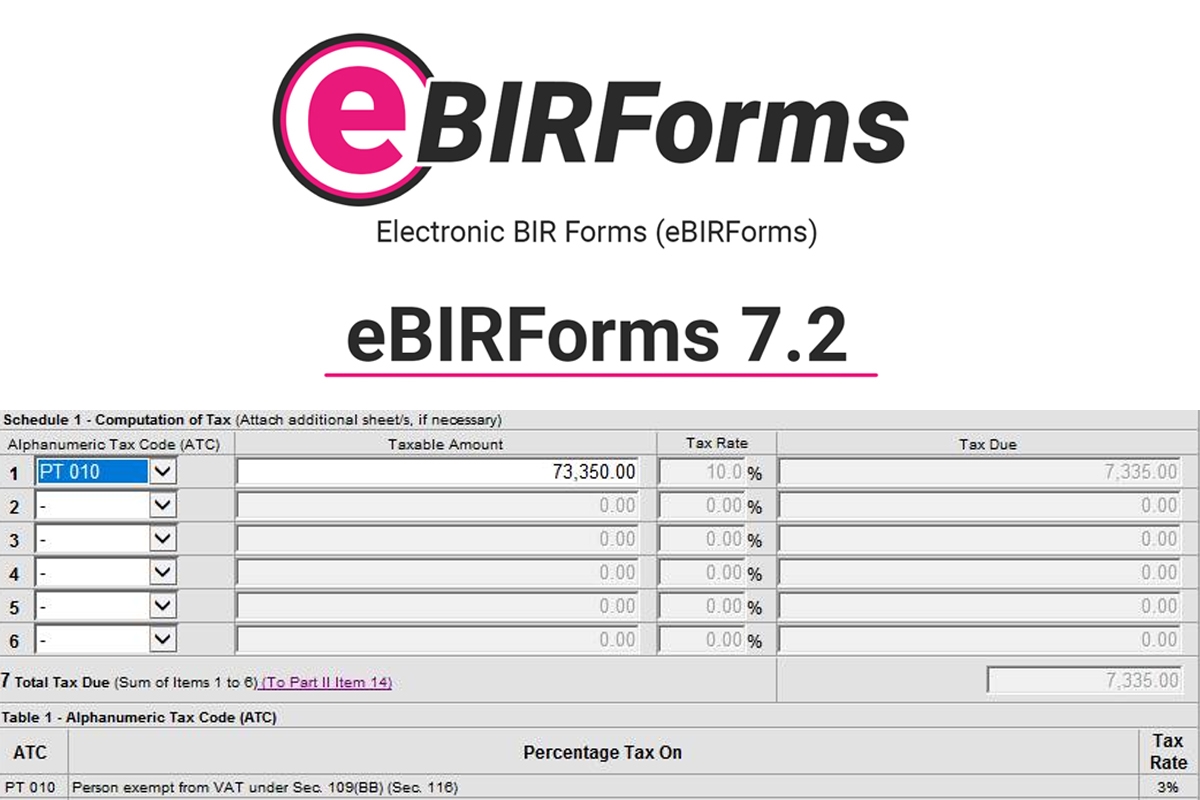

Ebirforms 7.4.1 Version

Manual and eBIRForms filers

The newly revised BIR Form No. 1701Q [refers to the new BIR Form No. 1701Q (Quarterly Income Tax Return) as revised due to the implementation of the TRAIN Law with revision date of January 2018 (ENCS)] is available under the BIR Forms-Income Tax Return section of the BIR website. Thus, taxpayers may download the PDF format of BIR Form 1701Q, print it, then fill out the applicable items/fields.

1) Unzip the downloaded package. 2) Double-click the file 'Offline eBIRForms Package v7.3 setup.exe'. 3) Follow all the instructions. However, it is recommended to install Version 7.3.1 on a separate folder, so just type in the folder 'C: eBIRFormsV7.3.1' when ask to select a different folder. After installation, copy the following folders from. 7.4.2 By Information Systems Group of the Bureau of Internal Revenue. The Electronic Bureau of Internal Revenue Forms (eBIRForms) was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient. Posted byswolesister 4 years ago.

EBIRForms Package version 7.6 now available 2020-03-18 - Source: P&A Grant Thornton Certified Public Accountants As announced in Revenue Memorandum Circular 16-2020, taxpayers can now download eBIRForms Package Version 7.6 from the BIR website.

In case a taxpayer paid the income tax due for the first quarter using the old return, the taxpayer still needs to file the newly revised BIR Form 1701Q and mark the return as an amended return. This is to determine whether or not the taxpayer is availing of the 8% income tax rate based on the gross sales/receipts and other non-operating income in lieu of graduated rates under Section 24(A)(2)(a) and percentage tax under Section 116 of the National Internal Revenue Code of 1997, as amended (Tax Code). The payment/s made shall be reflected in item no. 59 (Tax Paid in Return Previously Filed, if this is an Amended Return) of the newly revised BIR Form 1701Q.

If the computation resulted to a payable, manual filers shall pay the tax due thereon in accordance with the manner of payment below. Penalties shall apply if payment is made after the due date. If the result is no payment/overpayment, taxpayers are mandated to follow the existing procedure for 'No Payment Return', which is to file through the use of eBIRForms.

eFPS filers

The newly revised BIR Form No. 1701Q is not yet available for eFPS filers.

As a work-around, eFPS filers shall use the newly revised return in the Offline eBIRForms Package v7.1 to file the quarterly income tax return for the first quarter of 2018.

In case an eFPS filer paid the income tax due for the first quarter using the old return, the taxpayer still needs to file the newly revised BIR Form 1701Q and mark the return as an amended return. This is to determine whether or not the taxpayer is availing of the 8% income tax rate based on the gross sales/receipts and other non-operating income in lieu of graduated rates under Section 24(A)(2)(a) and percentage tax under Section 116 of the National Internal Revenue Code of 1997, as amended (Tax Code). The payment/s made shall be reflected in item no. 59 (Tax Paid in Return Previously Filed, if this is an Amended Return) of the newly revised BIR Form 1701Q.

If the computation resulted in a payable, eFPS filers shall pay the tax due thereon per manner of payment below. Penalties shall apply if payment is made after the due date.

Manner of payment

Payment of the income tax due for manual and eBIRForms filers shall be made through:

Manual payment

- Authorized Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office (RDO) where the taxpayer is registered

- In places where there are no AABs, the return shall be filed and the tax shall be paid with the concerned Revenue Collection Officer (RCO) under the jurisdiction of the RDO.

Online payment

- Thru GCash mobile payment

- Landbank of the Philippines (LBP) Linkbiz Portal, for taxpayers who have ATM account with LBP and/or for holders of Bancnet ATM/debit card

- DBP Tax Online, for holders of Visa Master/Credit card and/or Bancnet ATM/debit card

Intention to elect 8% income tax rate

A taxpayer shall signify his/her intention to elect the 8% income tax rate either by updating his/her registration using BIR Form 1905 or by checking/clicking item no. 13 in BIR Form No. 2551Q or item no. 16 in BIR Form No. 1701Q, and such election/option shall be irrevocable for the taxable year.

Reference: Revenue Memorandum Circular 32-2018

Open source project .NET DllExport with .NET Core support (aka 3F/DllExport)

https://github.com/3F/DllExport

🚀 Quick start: https://github.com/3F/DllExport/wiki/Quick-start

🔖 Examples. Unmanaged C++ / C# / Java: https://youtu.be/QXMj9-8XJnY

🧪 Demo: https://github.com/3F/Examples/tree/master/DllExport/BasicExport

gnt /p:ngpackages='DllExport/1.7.4'

https://github.com/3F/GetNuTool

S_NUM_REV: 1.7.4.29858

S_REL:

bSha1: c1cc52f

MetaCor: netstandard1.1

MetaLib: v2.0

Wizard: v4.0

Configuration: PublicRelease

:: generated by a vsSolutionBuildEvent 1.14.1.34071

Ebirforms 7.4 In Windows 10

!『 .NET Core support 』 1.7+

Use Conari 🧬 for work with Unmanaged memory including native or binary data from the heap; binding between .NET and unmanaged native C/C++, java, python, lua (LuNari), etc.

Please follow steps from official docs Adobe acrobat pro x for mac torrent.

!『 .NET Core support 』 1.7+

Use Conari 🧬 for work with Unmanaged memory including native or binary data from the heap; binding between .NET and unmanaged native C/C++, java, python, lua (LuNari), etc.

Please follow steps from official docs

Show moreRelease Notes

changelog: https://github.com/3F/DllExport/blob/master/changelog.txt

Dependencies

This package has no dependencies.

Used By

NuGet packages

This package is not used by any NuGet packages.

GitHub repositories (3)

Showing the top 3 popular GitHub repositories that depend on DllExport:

| Repository | Stars |

|---|---|

| microsoft/vs-threading The Microsoft.VisualStudio.Threading is a xplat library that provides many threading and synchronization primitives used in Visual Studio and other applications. | 655 |

| cnsimo/BypassUAC | 165 |

| rvrsh3ll/Rubeus-Rundll32 Run Rubeus via Rundll32 | 125 |

As a work-around, eFPS filers shall use the newly revised return in the Offline eBIRForms Package v7.1 to file the quarterly income tax return for the first quarter of 2018.

In case an eFPS filer paid the income tax due for the first quarter using the old return, the taxpayer still needs to file the newly revised BIR Form 1701Q and mark the return as an amended return. This is to determine whether or not the taxpayer is availing of the 8% income tax rate based on the gross sales/receipts and other non-operating income in lieu of graduated rates under Section 24(A)(2)(a) and percentage tax under Section 116 of the National Internal Revenue Code of 1997, as amended (Tax Code). The payment/s made shall be reflected in item no. 59 (Tax Paid in Return Previously Filed, if this is an Amended Return) of the newly revised BIR Form 1701Q.

If the computation resulted in a payable, eFPS filers shall pay the tax due thereon per manner of payment below. Penalties shall apply if payment is made after the due date.

Manner of payment

Payment of the income tax due for manual and eBIRForms filers shall be made through:

Manual payment

- Authorized Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office (RDO) where the taxpayer is registered

- In places where there are no AABs, the return shall be filed and the tax shall be paid with the concerned Revenue Collection Officer (RCO) under the jurisdiction of the RDO.

Online payment

- Thru GCash mobile payment

- Landbank of the Philippines (LBP) Linkbiz Portal, for taxpayers who have ATM account with LBP and/or for holders of Bancnet ATM/debit card

- DBP Tax Online, for holders of Visa Master/Credit card and/or Bancnet ATM/debit card

Intention to elect 8% income tax rate

A taxpayer shall signify his/her intention to elect the 8% income tax rate either by updating his/her registration using BIR Form 1905 or by checking/clicking item no. 13 in BIR Form No. 2551Q or item no. 16 in BIR Form No. 1701Q, and such election/option shall be irrevocable for the taxable year.

Reference: Revenue Memorandum Circular 32-2018

Open source project .NET DllExport with .NET Core support (aka 3F/DllExport)

https://github.com/3F/DllExport

🚀 Quick start: https://github.com/3F/DllExport/wiki/Quick-start

🔖 Examples. Unmanaged C++ / C# / Java: https://youtu.be/QXMj9-8XJnY

🧪 Demo: https://github.com/3F/Examples/tree/master/DllExport/BasicExport

gnt /p:ngpackages='DllExport/1.7.4'

https://github.com/3F/GetNuTool

S_NUM_REV: 1.7.4.29858

S_REL:

bSha1: c1cc52f

MetaCor: netstandard1.1

MetaLib: v2.0

Wizard: v4.0

Configuration: PublicRelease

:: generated by a vsSolutionBuildEvent 1.14.1.34071

Ebirforms 7.4 In Windows 10

!『 .NET Core support 』 1.7+

Use Conari 🧬 for work with Unmanaged memory including native or binary data from the heap; binding between .NET and unmanaged native C/C++, java, python, lua (LuNari), etc.

Please follow steps from official docs Adobe acrobat pro x for mac torrent.

!『 .NET Core support 』 1.7+

Use Conari 🧬 for work with Unmanaged memory including native or binary data from the heap; binding between .NET and unmanaged native C/C++, java, python, lua (LuNari), etc.

Please follow steps from official docs

Show moreRelease Notes

changelog: https://github.com/3F/DllExport/blob/master/changelog.txt

Dependencies

This package has no dependencies.

Used By

NuGet packages

This package is not used by any NuGet packages.

GitHub repositories (3)

Showing the top 3 popular GitHub repositories that depend on DllExport:

| Repository | Stars |

|---|---|

| microsoft/vs-threading The Microsoft.VisualStudio.Threading is a xplat library that provides many threading and synchronization primitives used in Visual Studio and other applications. | 655 |

| cnsimo/BypassUAC | 165 |

| rvrsh3ll/Rubeus-Rundll32 Run Rubeus via Rundll32 | 125 |

Version History

| Version | Downloads | Last updated |

|---|---|---|

| 1.7.4 | 18,365 | 1/2/2021 |

| 1.7.3 | 19,850 | 6/12/2020 |

| 1.7.1 | 5,722 | 5/7/2020 |

| 1.7.0-beta3 | 741 | 12/15/2019 |